AN INVESTMENT IN WELL-BEING

Clarity Benefit Solutions’ SimplyWell Lifestyle Spending Account (LSA) gives you the flexibility to create personalized benefit programs for employees. A convenient Benefit Card makes it easy for them to spend on what matters most.

Clarity SimplyWell is a creative way to build a supportive culture and to attract, engage, and retain top talent. With a wide range of spending categories, from home office goods to fitness to education, or even pet care, you can offer lifestyle spending account benefits that are tailored to your unique workforce and business needs.

Enrich the Lives of Your Employees

With SimplyWell you can enrich the lives of employees with personalized, easy-to-use payment solutions:

- Post-tax spending account

- Employers provide to employees via a debit card

- Employer defines cash amount, fund availability & eligible purchases

- Flexible and configurable using a pre-built list of merchant category codes

- Distinct from HSAs & FSAs – but can be stacked on the same multi-purse card, based on plan design

PROGRAM STRATEGIES TO MEET CLIENT NEEDS

Clients have the flexibility to design their own programs based on MCC codes, or apply one of our recommended solutions…

- PROFESSIONAL DEVELOPMENT

Retain existing talent and open talent pool - HEALTHY LIVING

Increase engagement and boost employee wellbeing - WORK FROM HOME

Support a positive work environment and engage with remote workforce - LEISURE/HOBBIES Promote work/ life balance

- FAMILY CARE

Support a diverse workforce that increasingly identifies as caregivers

HOW DOES CLARITY SIMPLYWELL WORK?

- Employer decides to offer a lifestyle account as a benefit

- Employer determines total program budget, fund duration availability, and policy for unused funds

- Employer allocates dollars to allowed spending categories (using pre-approved MCCs) and per-category limits

- Employer communicates Clarity SimplyWell availability to employees

- Employees receive cards & spend funds (while employers get full insight into utilization & spending)

HOW IS SIMPLYWELL Different FROM OTHER HEALTH BENEFIT ACCOUNTS?

Unlike a health savings account (HSA) or flexible spending account (FSA), a lifestyle spending account (LSA) does not offer any tax advantages. Funds are exclusively employer-funded and are considered taxable income for your employees.

With HSAs and FSAs, there are restrictions on the use of funds, but these are typically set by the IRS. With lifestyle spending accounts, you create the program spending parameters within the approved spending categories.

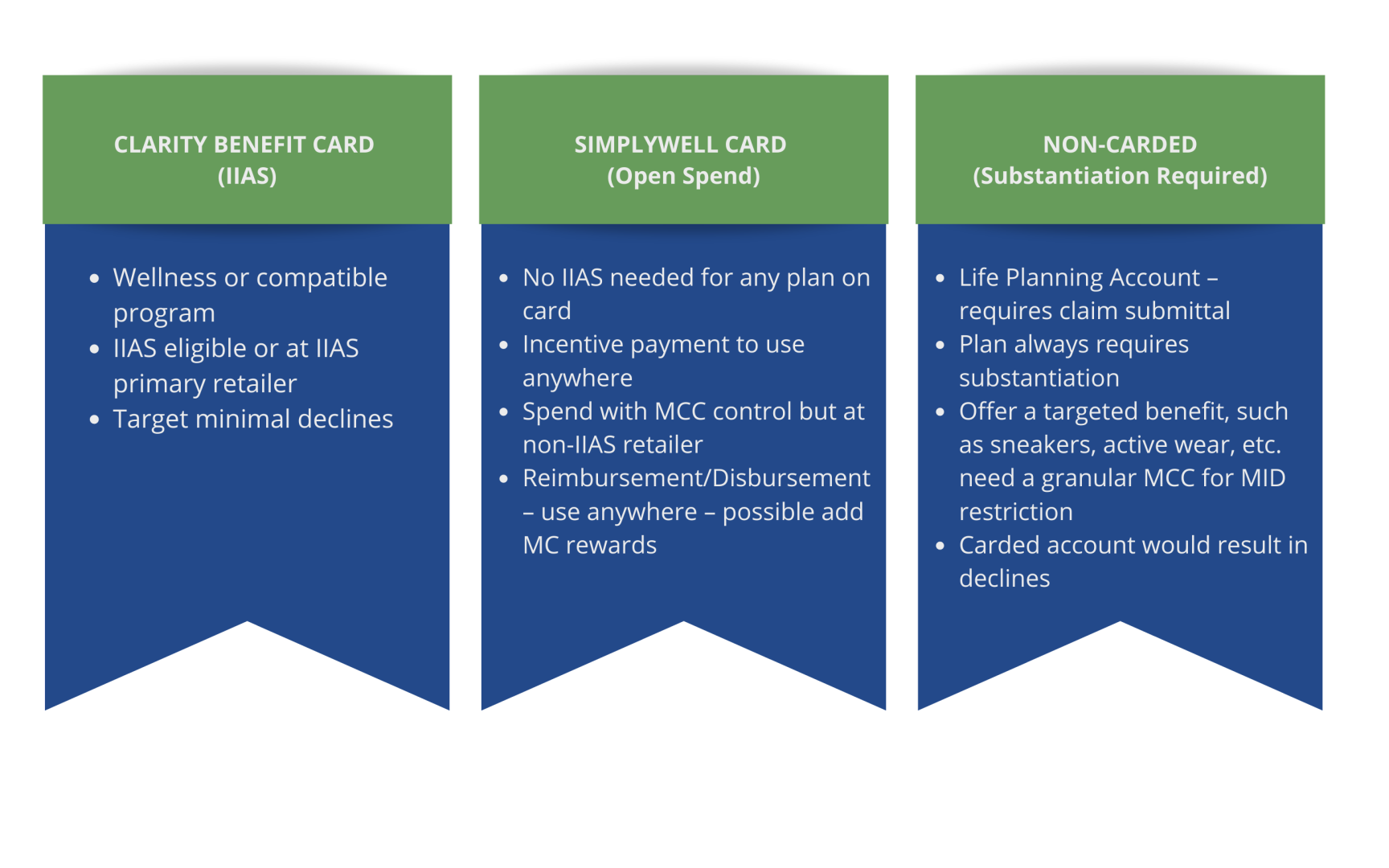

YOU CHOOSE INCENTIVE OR HEALTH CARD

SETTING UP YOUR SIMPLYWELL PROGRAM IS SIMPLE

Identify program goals

- Explore how to meet your employee’s unique needs

Customize spending amounts & limits

- Designate the amount to contribute per employee.

- Determine limits for specific service types – choose from approved spending categories

Define eligibility parameters

- Is the same benefit being offered to all employees or just a subset?

- Do you need a tiered approach (ex: full- vs. part-time employees)?

Communicate with employees

- Promote your offering.

- Communicate the purpose, the amount employees will receive, how and where they can spend their funds, and how they can manage their account.

Measure & refine

- Identify and measure KPIs and engagement

- Adapt your offering over time as employee’s needs change